This is your way of showing Financial Performance in terms of a Profit and Loss Statement rather than a Cash Statement.

This is your way of showing Financial Performance in terms of a Profit and Loss Statement rather than a Cash Statement.

The Cash Statement (refer reports menu) represents all the Money In and Money Out that have gone through your books for a specified period. There is no distinction between what may be a capital expense or an ordinary expense.

The Profit Statement (refer reports menu) attempts to give you an idea of profits from your business by excluding payments that generally have a life beyond the current year.

As an Example

A Capital expense would be a payment made for an item that can be used beyond a financial year. So it could be a $50,000 piece of equipment that will last you for five years. If you just expensed that item in the current year, it would distort your profit for that year.

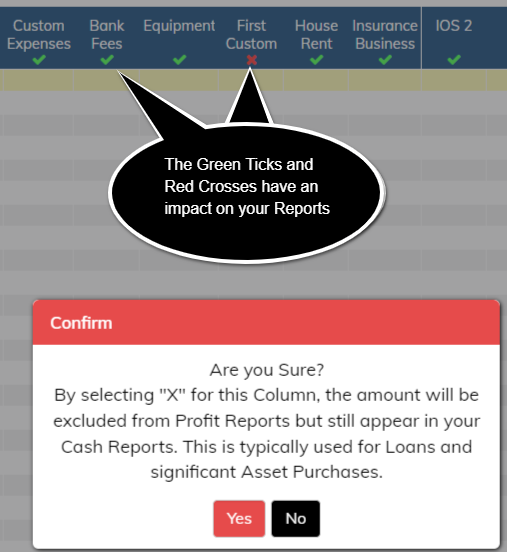

To overcome that distorting, without going full stream accounting, you can just choose to "Untick" that column and the amounts in the column will not appear in your Profit Reports. That simple, then at year end your accountant can sort out the correct accounting allocation.

By selecting "X" for a Column, the amount will be excluded from Profit Reports but still appear in your Cash Reports. This is typically used for Loans received and significant Asset Purchases.