Money In represents the money you are receiving from your customers as well as Money in from Non Sales sources, such as loans.

Money In represents the money you are receiving from your customers as well as Money in from Non Sales sources, such as loans.

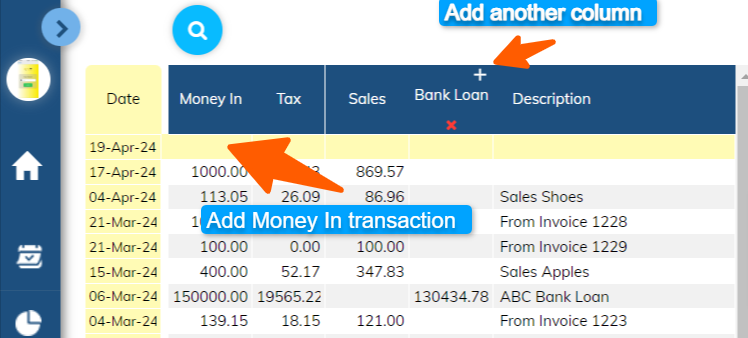

Click the Money In area and the screen will expand allowing you to record Money In transactions.

These transactions will usually come in the form of sales.

You may receive other forms of money. If your receipt of money is NOT for sales (or Income) then you should describe the transaction to identify it and record the transaction under a column header other than "Sales". Otherwise you run the risk of the transaction being treated as Income and you'll end up paying tax on it. If the transaction is not income, then ensure a column identifies it as such and make sure the column "X" is engaged.

It's always a good idea to record a description to receipts that are NOT sales or Income, simply use the description box.

Always ensure the GST/VAT calculated is correct. They can vary from time to time due to rounding variations or different treatment of income types. The system will automatically calculate the GST/VAT, check it and, if different, change the amount to the correct amount.

NON Sales or Income receipts should NOT have GST in them and you should change any automatic GST/VAT calculation to ZERO.

If you are generating Invoices from the system your Invoices will be marked "Not Paid" until you action them. By simply clicking the "Not Paid" button you will be given an option to transfer the amount to "Money In". This saves you recording the entry again into Money In.