As long as you've entered all your data and you've checked the GST on each transaction you can create a BAS Statement that is compliant with the ATO. It's always good to get someone to glance over it or create the Statement for you, so you may choose to engage your Accountant at this point.

As long as you've entered all your data and you've checked the GST on each transaction you can create a BAS Statement that is compliant with the ATO. It's always good to get someone to glance over it or create the Statement for you, so you may choose to engage your Accountant at this point.

The process is as follows:

Make sure all your transactions have been recorded for the quarter.

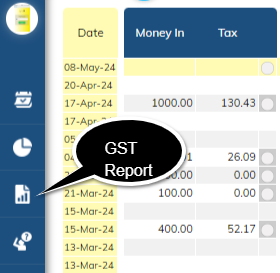

Go to the LEFT HAND side Menu

Find the REPORTS Icon

Select GST REPORT

The BAS Report will appear.

Look at the QUARTER you are doing at the moment and make sure the correct Quarter is selected.

Answer the question on Private Usage, it's default is YES, but most business will need to select NO, then click continue

Run down the list of Expenses and change the Business use if that Expense item was used for private purposes

Select Continue

Check the paranters and click CONTINUE

Your BAS statement should now be complete. You may need to add amounts at T1 and T2

Log into your MyGov account and replicate the BAS Statement there.