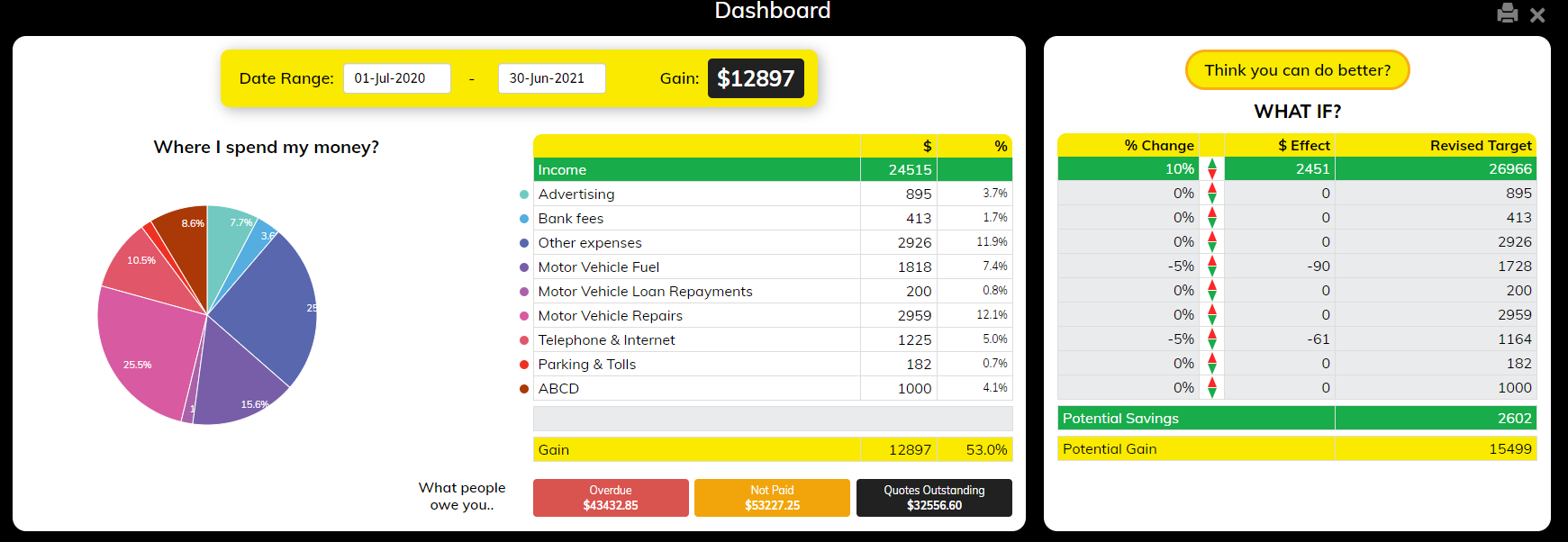

Your Performance Dashboard shows you a snap shot of where you are at with your business. If you're diligent with your transaction processing then you should be viewing a current financial view of your operations.

Your Performance Dashboard shows you a snap shot of where you are at with your business. If you're diligent with your transaction processing then you should be viewing a current financial view of your operations.

The Dashboard will display your results for a specified Date Range.

Hover over the Pie Chart to get more details on your expenses.

Your Summary result comes with Income, Expenses, and the percent your expenses and profit form of the total mix. You can use this to identify excesses in spending or realisation of bad sales pricing on your invoicing. Look also at your profit margin, that's the percentage at the bottom, and make sure you determine what percentage number you should be focused on. As an indicative range (depending on the market you serve), you should be looking for percentages between 5% to 20%.

It also displays who OWES you money, including any OVERDUE Invoices with any QUOTES that you may have outstanding. Awareness and action of overdue Invoices are vital to maintain a healthy cashflow. .

What If Table

To the RIGHT hand side of your Performance Dashbord is a handy WHAT IF table. Adjust the % Change to see what effect it would have on your Profits, providing insight into the allocation of your resources.

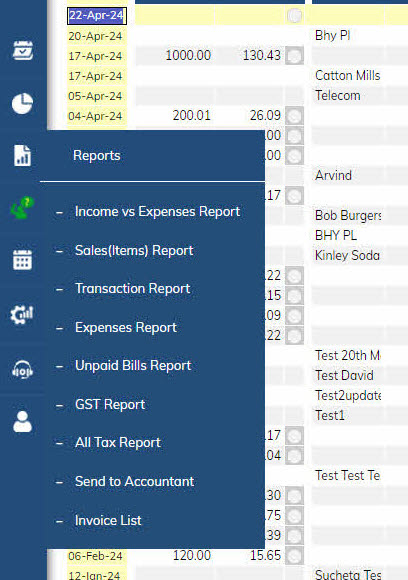

The Cashbook comes equipped with a few useful Reports.

The Cashbook comes equipped with a few useful Reports.

INCOME Vs EXPENSES Report - tabulates your transactions results either Yearly, Monthly or Quarterly. Mouse over the graphics to get more detail.

SALES (Item) Report - handy to analyse your Sales. Only available to those that use the Items Invoicing System.

TRANSACTION Report - Lists all your transactions for easy reference in date order either yearly, monthly, or quarterly.

EXPENSES Report - Lists all your transactions in CATEGORY order yearly, monthly or quarterly.

INVOICE LIST - Lists out all your Invoices (and Quotes) you have issued over a date range.

UNPAID BILLS Report - for those that enter forward dated purchase Invoices, this will be a list of purchase Invoices that remain to be paid

GST Report - you'll need this to do your GST Return.

ALL TAX Report

Send to Accountant - not sure what you've done or need a second opinion, this will allow you to send the information to your Accountant that they need to undertake your BAS or Tax Return.

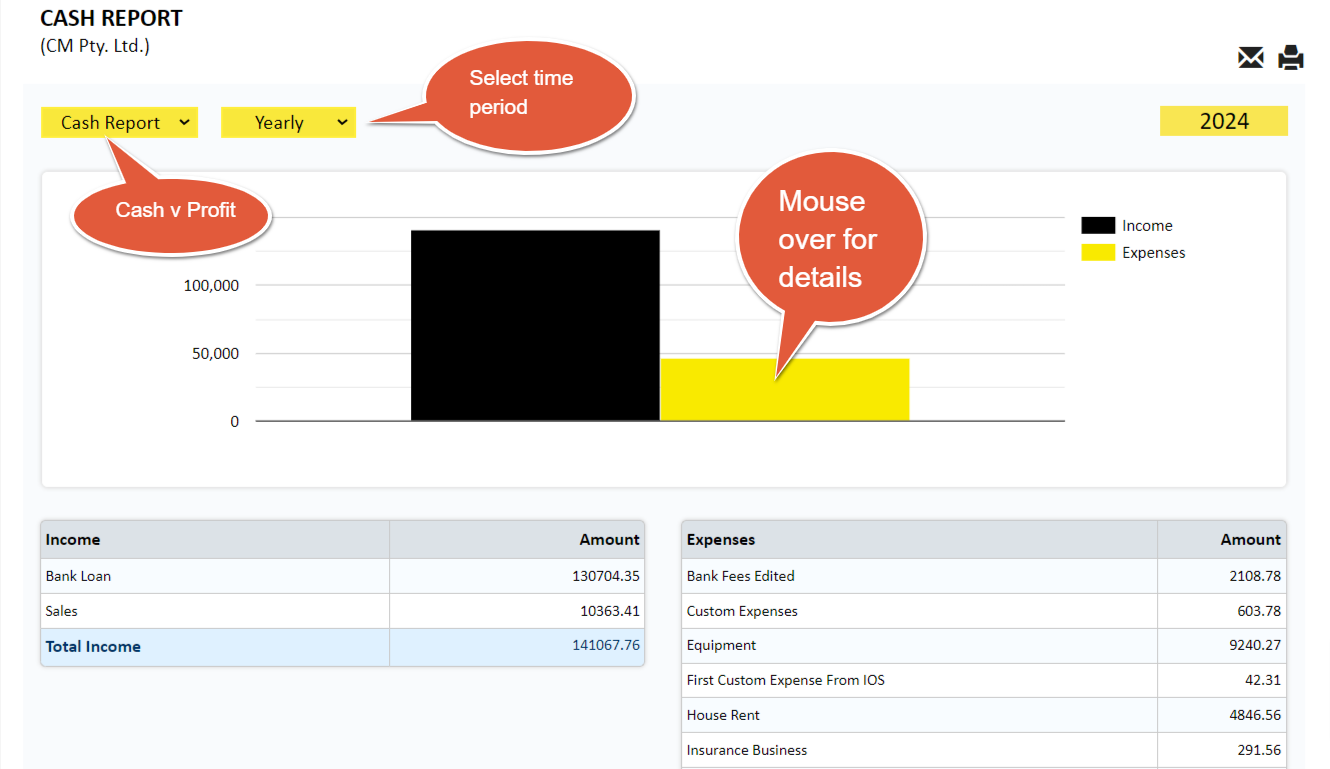

No doubt you've heard about a Profit and Loss Report, well the Income and Expense Report is the eCashbooks' equivalent.

No doubt you've heard about a Profit and Loss Report, well the Income and Expense Report is the eCashbooks' equivalent.

The Income and Expense Report will list all of the MONEY In and MONEY OUT transactions for a date range and calculate an end result for you, your Surplus. And remember it's always better to have more coming in than going out.

The OPTIONS under this report are:

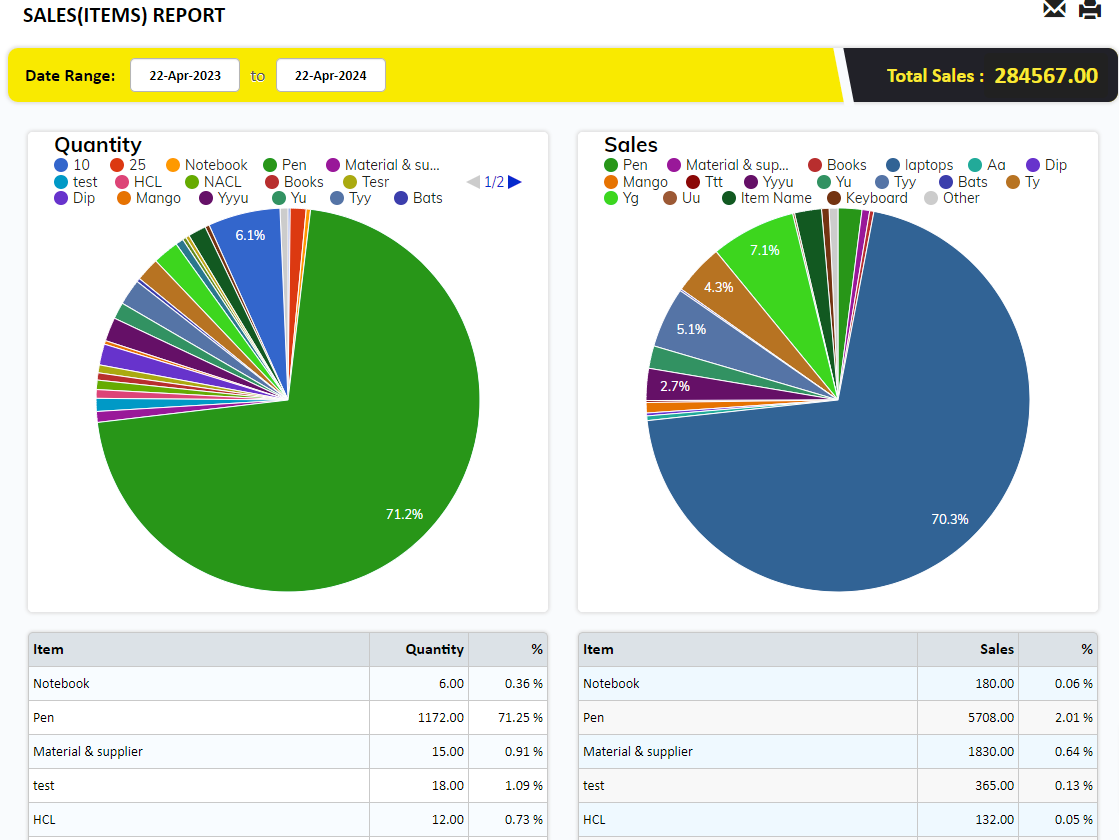

If you use the ITEM Invoice Type you can generate this report to add some insight into your Sales. When you Invoice your customers you have TWO invoice types available to use. The first one, SERVICE, is simply a description of the service you have provided with the amount for the service. The second is, ITEM, where you charge out a value per item with the number of items sold.

If you use the ITEM Invoice Type you can generate this report to add some insight into your Sales. When you Invoice your customers you have TWO invoice types available to use. The first one, SERVICE, is simply a description of the service you have provided with the amount for the service. The second is, ITEM, where you charge out a value per item with the number of items sold.

This report is in reference to the ITEM invoicing system.

The Report looks at Sales in numbers and Quantity in Numbers. Effectively your Sales Mix.

Knowing that most of your sales are coming from a few items can assist in your pricing and marketing strategy.

Awareness of your Sales Mix can impact future decision making.

You can Select a Date Range to suit.

From the REPORTS MENU (Left Hand Side), select TRANSACTION Report

This will list all your Transactions for a specified period by Date for MONEY IN and MONEY OUT.

Mouse over the Graph to SHOW more content.

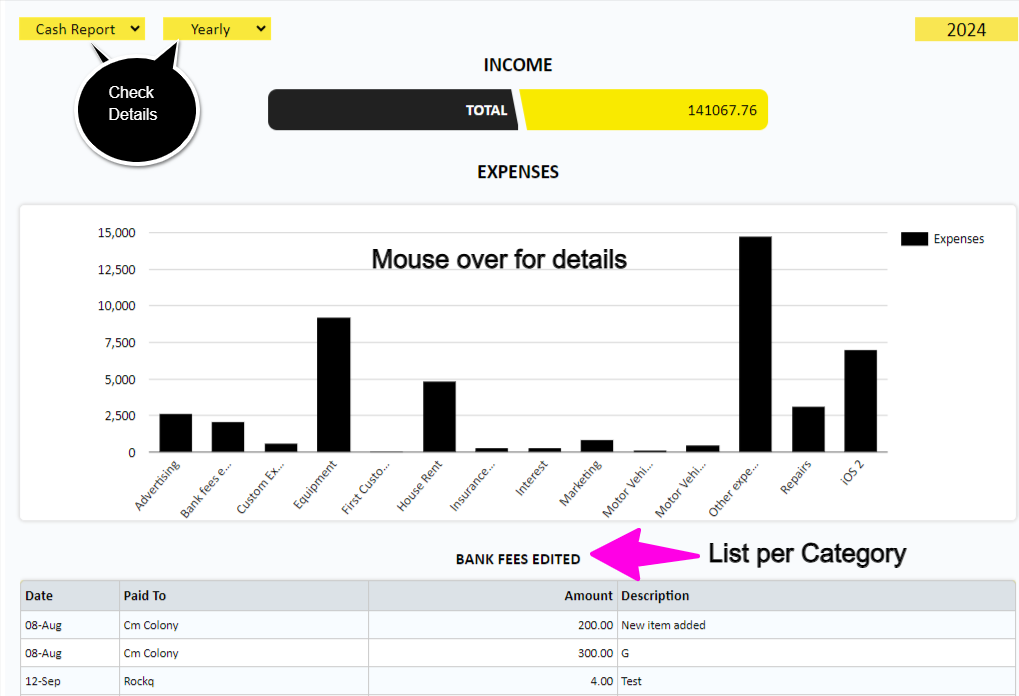

You will find your Expenses Report under the Report Menu Icon on the left hand side.

This will list all of your expenses by CATEGORY. Simply run down the report to see all of the transactions.

Make sure you select the Report type, default is the CASH REPORT, and select the time period.

Mouse over the graph for additional Information.

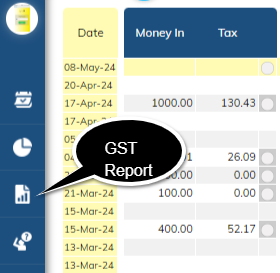

As long as you've entered all your data and you've checked the GST on each transaction you can create a BAS Statement that is compliant with the ATO. It's always good to get someone to glance over it or create the Statement for you, so you may choose to engage your Accountant at this point.

As long as you've entered all your data and you've checked the GST on each transaction you can create a BAS Statement that is compliant with the ATO. It's always good to get someone to glance over it or create the Statement for you, so you may choose to engage your Accountant at this point.

The process is as follows:

Make sure all your transactions have been recorded for the quarter.

Go to the LEFT HAND side Menu

Find the REPORTS Icon

Select GST REPORT

The BAS Report will appear.

Look at the QUARTER you are doing at the moment and make sure the correct Quarter is selected.

Answer the question on Private Usage, it's default is YES, but most business will need to select NO, then click continue

Run down the list of Expenses and change the Business use if that Expense item was used for private purposes

Select Continue

Check the paranters and click CONTINUE

Your BAS statement should now be complete. You may need to add amounts at T1 and T2

Log into your MyGov account and replicate the BAS Statement there.

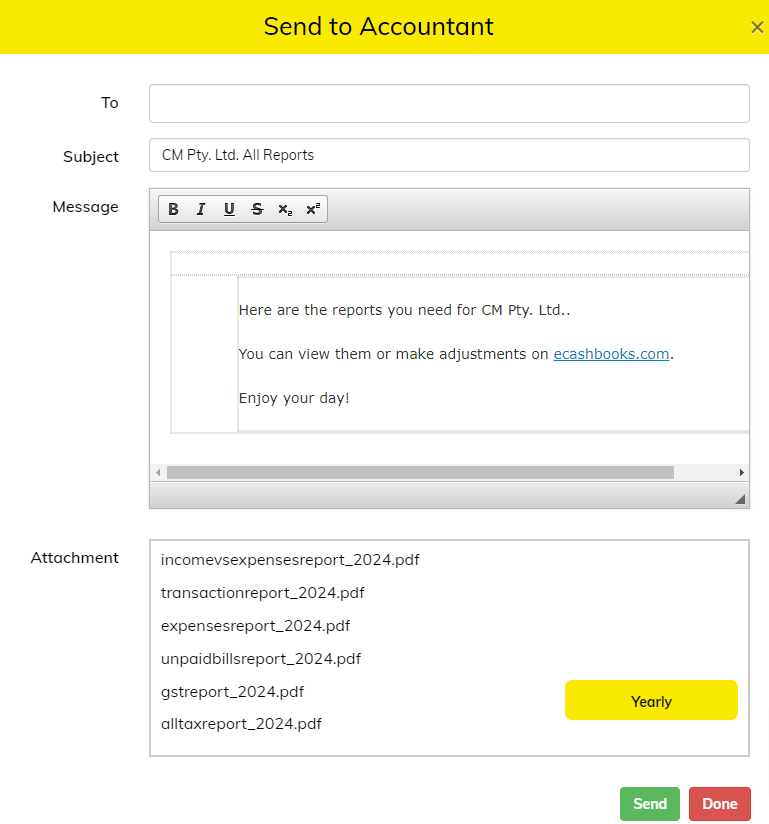

The Reports required by your accountant to attend to your tax matters are prefilled for you.

The Reports required by your accountant to attend to your tax matters are prefilled for you.

You can also (if needed) allow access of your eCashbooks file to your Accountant.

This function you'll find in the left hand side menu under REPORTS.

Send To Accountant

Select this option if you require information to be sent to your Accountant for any reason.

Select the Year applicable.

Simply enter the email address of your accountant.

In the ATTACHMENT AREA select the report dates, yearly or quarterly and click SEND.

The following attachments will automatically populate your email:

You can allow your accountant to access your file.

Some users are quite happy just to use the software through the App, whilst giving site access to their Accountant or partner to control the finer details.

It's not a bad idea.

You can use the eCashbooks Mobile APP to record your Invoices, Quotes and your transactions as they occur.

Your Accountant or Partner can then check your file and add the missing bits. Giving them access also means they will have real time data they need at anytime and from anywhere.

Simply give your accountant your LOGIN and you're right to go.

There is NO need for separate registration for your Accountant.

Be aware, of course, that you'll be sharing your username and password. And you can change that at anytime you please if your situation changes.