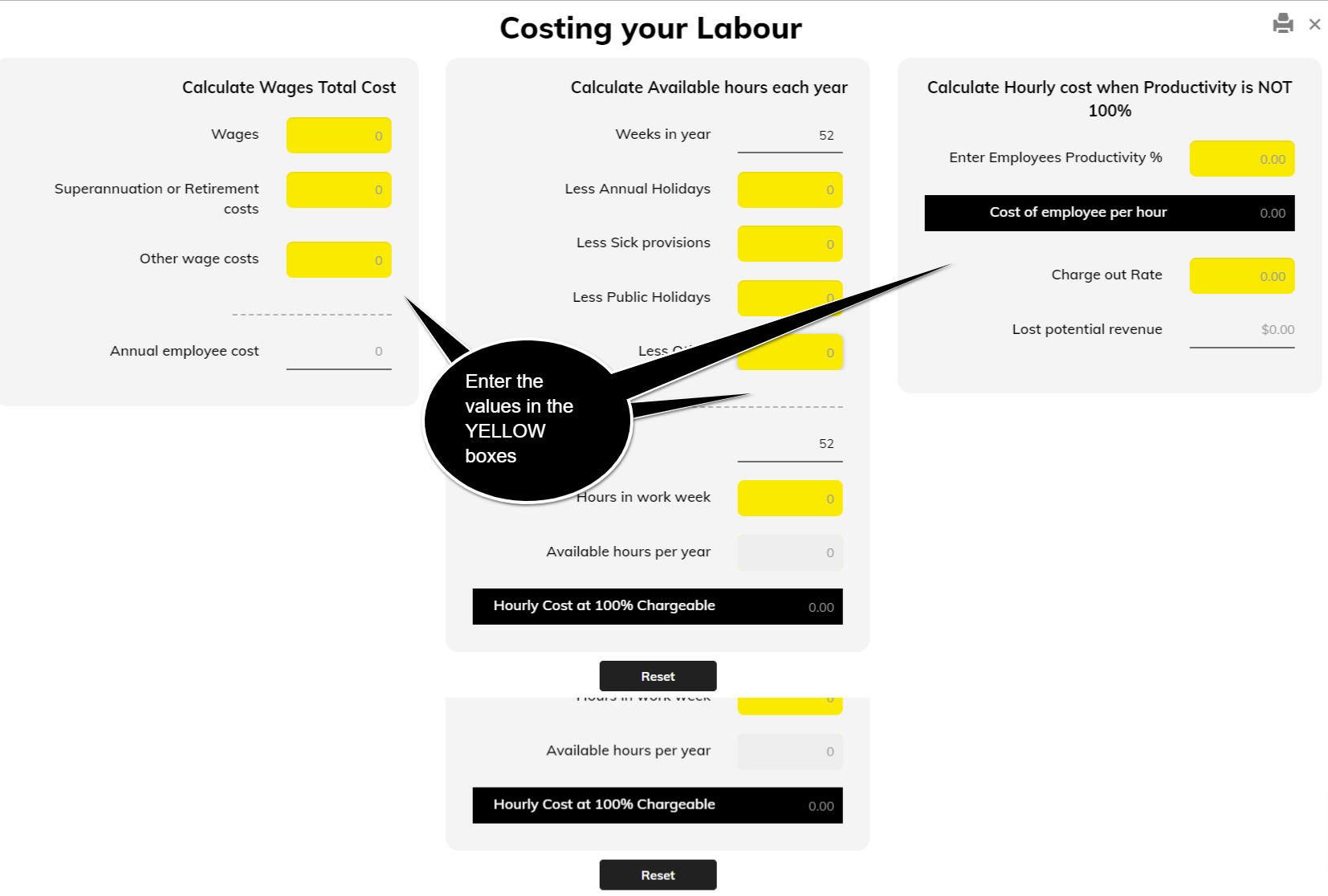

Know your labour cost. Not knowing this cost and your charge out rates is often the difference between success and failure. Get on top of your numbers.

Know your labour cost. Not knowing this cost and your charge out rates is often the difference between success and failure. Get on top of your numbers.

A necessary skill that’s required to ensure what your employees really cost you and whether you are at least recovering their cost. The Key to this costing is their productivity.

Productivity is simply the hours you change out at for a particular employee in a given week. There is another Smart menu that handles this calculation. Being a business person, you should realise that you need to charge out your employees at a rate higher than what they cost you.

If you don’t have a precise number, that’s ok. Don’t get caught up in the numbers. You can waste a lot of time being precise whereas “rough” will give you a sufficient result to make decisions on.

NOTE: This calculation is purely the true "cost only" of your staff member. It does not include a calculation for overhead or profit that you need to charge on top of your Labour cost. It’s these numbers that combine to give you the employee's "Charge Out Rate".

The Costing Your Labour screen concludes with an hourly cost rate to determine what the Charge Out Rate you are using is valid or needs to be revised.

Bear in mind that the key number here is the “productivity” of the employee.

Here we determine the true cost of your employee annually. That includes his wages and any other amounts you pay on their behalf as the reward for their services to you. That is superannuation or retirement plans, medical benefits, salary sacrifice arrangements and any other cost that you make as reward for their services.

This is based on the number of weeks (not hours) throughout the year that are allocated for Annual Leave, Sick leave, Public Holidays and any other leave that takes the employee away from productive activity.

No employee is perfect, and they are certainly never 100% productive, though that should always be your aim. As such, it costs your business when they are not productive. This calculation recalculates their hourly cost when your employee is not 100% productive. As a simple example, your employee costs you 40 per hour when they are 100% productive. If they are only 50% productive, then their cost doubles. Why? because they may turn up for 40 hours a week, but you have only 20 hours to recover their cost.

This is the Potential of keeping your staff member fully engaged throughout the working week as opposed to the results you are getting. It's a reflection of the cost of inefficiency within your business. For instance, 2 staff members at 50% efficiency each can be replaced by one staff member at 100% efficiency, thereby saving costs.

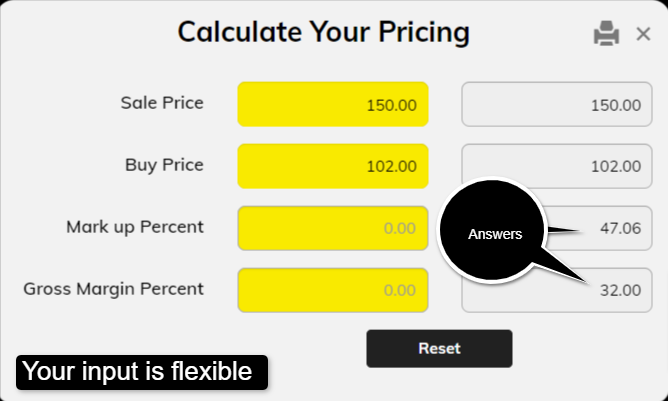

Here you can check that you're getting the right margins on your products. Calculate your Sale price based on Mark up. There are many variables to choose from. Play with it and understand your numbers. Gross Margin and Mark Up and critical percentages that you must have awareness of.

You can calculate for any of the following:

Any two inputs will produce a result. The Results are displayed in the Right Hand Column.

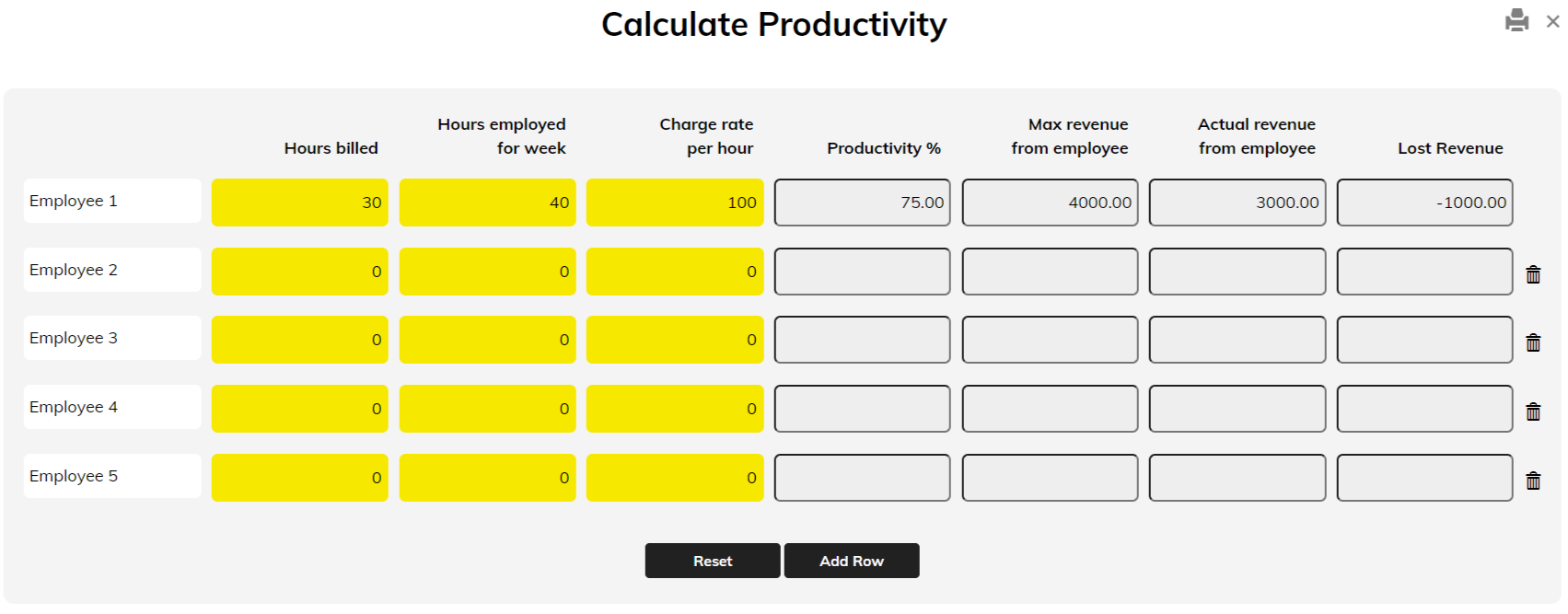

Knowing the effect of staff productivity on your numbers is a must.

Work out the PRODUCTIVITY based on the hours your have charged out against the hours they are getting paid for.

Simply enter:

Look at the Maximum Potential Revenue and the POTENTIAL lost revenue.

Search out the reasons for Low PRODUCTIVITY and take action.

Go through the exercise weekly to determine where you stand.

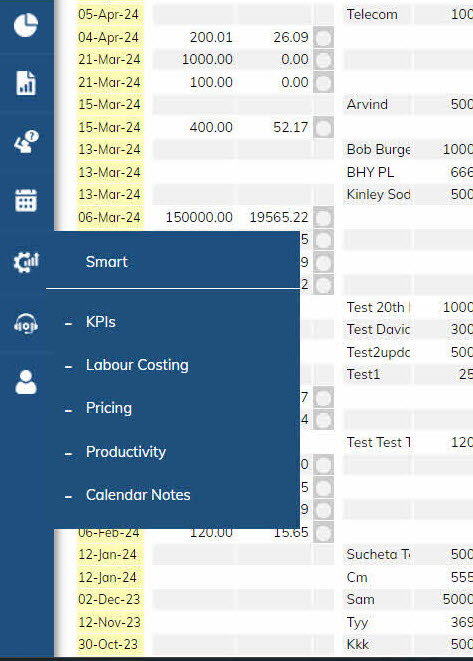

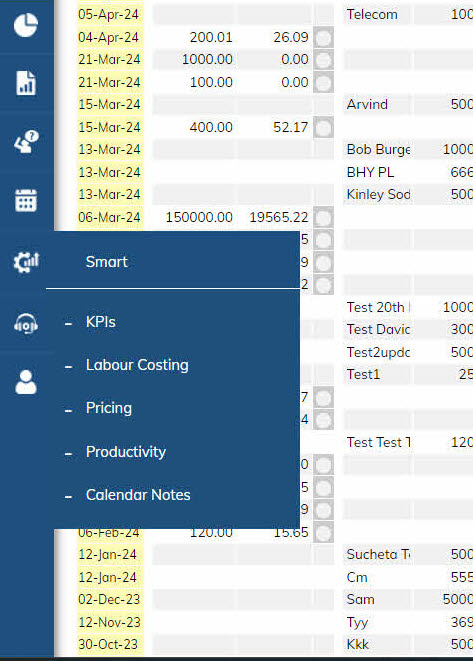

You'll find the PRODUCTIVITY through the SMART MENU located in the left hand side MENU PALLETTE.